“It’s just five dollars. I’ll start saving my money after this.”

“It’s just such a good deal, these are never on sale!”

“I’ve wanted one for a long time, why keep waiting?”

“That restaurant sounds so good right now, let’s go?”

“I’ll just pull from my savings and pay myself back next paycheck.”

“What if it goes out of stock before I can buy it?”

“You only live once, right?”

If you are being honest with yourself, you will agree that you have probably already told yourself one or more of these things just today.

I mean, I would be lying if I said I haven’t.

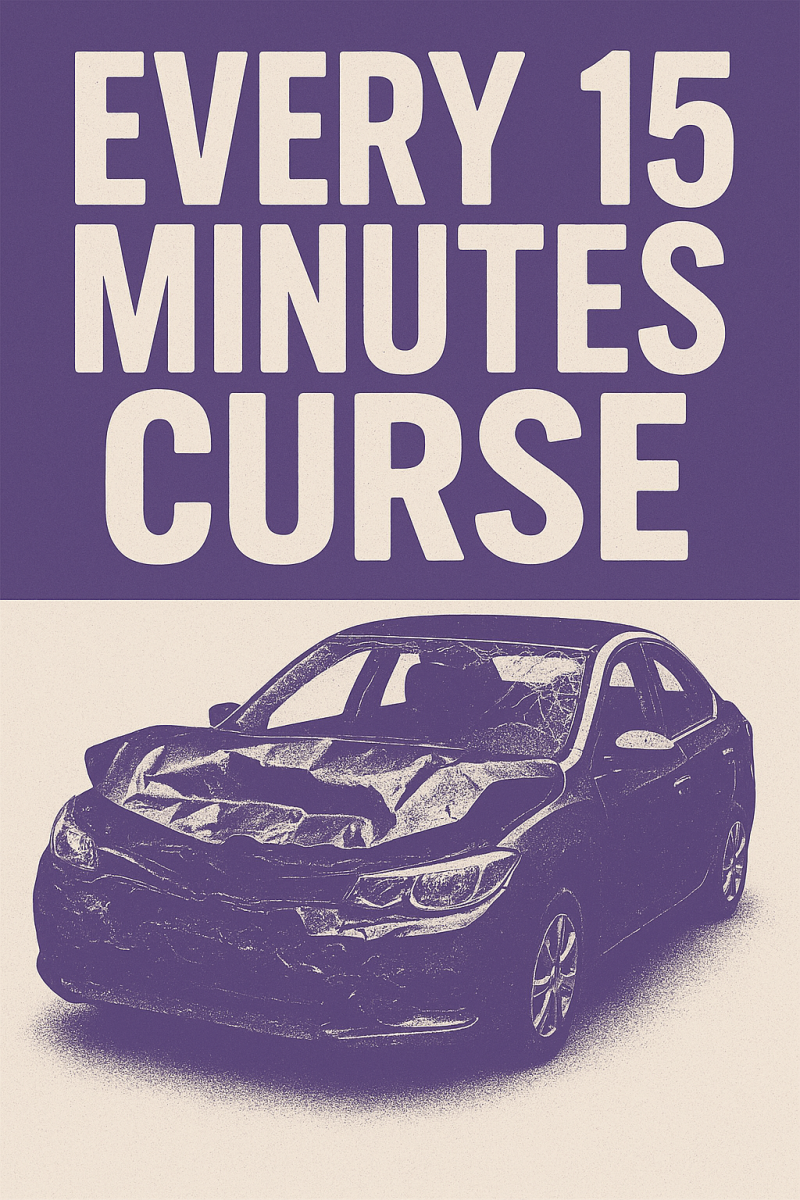

The truth is, we are teenagers. Not only are we teenagers, but we are also human. We are a naturally selfish population that craves satisfaction, often going to extreme measures to find it. In this case, I am referring to the concern of overconsumption and overspending money on things we don’t need. I will echo the words of Madonna when she said we are living in a “material world” because that couldn’t ring truer than it does today.

To help me understand this better from a teenager’s perspective, I sent out an anonymous survey to students at our school regarding their spending habits. I wanted to see how my peers view money, and some of the responses I got surprised me. I have picked my top three favorite questions to address and will share the data and my opinion for each.

For context, this survey was taken by 57 PHS students ranging in age from 14-18. Out of those 57 students, only 42% of them have a job- that is 24 students. Having this information before reading further may help you better understand some of the data received. So, without further ado, here are the three questions:

- If you don’t have a job, how do you get money? (Question 5)

- Why do you find it important to save money in high school? (Question 6/7)

- What influences your money habits the most? (Question 13)

Question #1: If you don’t have a job, how do you get money?

Being that only 42% of students who answered this had a job, I decided to ask where those who didn’t have a job typically get their money. The results of this question were surprising. 53% (23 people) said their parents give them money, while 44% (19 people) said they complete small jobs to earn money. However, only one response said their friends give them money when they hang out.

Honestly, these results surprised me! I was convinced that the percentage of friends buying for each other would be way higher than 2%, but I was proved wrong! As a student who has been very self-motivated to find work throughout high school, I find it frustrating to see others around me who constantly rely on their friends to pay for things when they go out (acknowledging that this is without the intention of paying them back). The survey results show this is not as common as I assumed, which is relieving to me! On the other hand, I loved seeing that out of 43 people who answered this question, 19 of them found various ways to earn money through completing jobs like yard work, babysitting, cleaning, etc. I feel like as high schoolers we live in a time that often gets backlash for our 24/7 access to social media, video games, or electronics in general, which causes some to think we may not have a strong work ethic. Yet, even with constant distractions and new technological advancements, my peers still want to work, and it helps me feel more hopeful for the future of our world.

While I love that so many of my peers have the desire to work, I don’t think anyone should feel bad if they decide to not work as a teenager. For some of us, getting through high school and passing all our classes may be a full-time job. That is okay! If you are focusing on school, sports, other extracurriculars, or even your mental health, do not feel pressured to get a job if it is not the best time in your life (especially if you do not need to help support your family financially). To be honest, the only reason I started working in fast food two years ago was to get me out of the house. Not even kidding. My mental health had been declining and I needed something to fill my time after the school day. This may not be the case for most people; just make sure you are doing what is right for you in the end!

Question 2: Why do you find it important to save money in high school?

This question was ultimately two- parts. The first being “Do you find it important to save money while in high school?”, which had a 100% answer rate of “yes” by all 57 students. The following question asked them to briefly explain their answers. Here are a few real responses I received:

“It’s important for teenagers to be able to be responsible for money and learn how to spend it correctly. There’s also a sense of ownership to being able to purchase things yourself!”

“Yes, because not only do you never know when something might come up, such as an emergency or an event, it is also a good habit to have and will help you prepare to save money for your future.”

“I think that saving money is vital for after high school. When kids graduate and have to live on their own, starting to provide for yourself from scratch is insanely hard. So having some resources beforehand is smarter and more efficient.”

“It’s important because it allows you to have backup money in case you start running low on funds for rent or food”

“It’s important to save so you can have a bit more wiggle room with college money or getting yourself a car. And also I like to save enough so that I can go do activities without worrying if I have the money or not.”

“Learning how to budget while you still have the security of living at home is super important”

Based on these few responses, you can probably see a common theme developing. This shows me that students understand the value of saving money starting at a young age, even if it is hard to put it into practice at times. Some of us save our money so we can be prepared during an emergency. Others want to combat the cost of college or may have a desire to develop good budgeting habits while still living at home. I can’t forget the large percentage of us who also save money so we can go out and treat ourselves on occasion! Having fun is important- life is to be enjoyed! Having some extra cash for those spontaneous moments of life feels very rewarding- even if that means saying bye to Dutch Bros for a few days occasionally to do so. As I mentioned, my initial reason to get a job was to keep myself busy- it wasn’t about the money for me. However, my parents always encouraged me to put a portion aside from each paycheck into my savings account. Because of that, my savings have grown immensely over the past two years, and I don’t feel as panicked about college.

I also feel like in high school it is good to start practicing sacrifice. What do I mean by that? Many adults must make many financial sacrifices to sustain themselves or their families, and if you don’t have any experience with how that feels it is going to make life way more difficult when the time comes. Sacrificing the daily Starbucks or vending machine snack for one day may not feel productive at the moment, but sometimes it’s not about saving money- it’s about learning how to say no to ourselves on occasion and understanding that the world does keep spinning. It is a skill my parents are very good at, and their example has helped me be intentional with how I spend my money.

Question #3: What influences your money habits the most?

This question was multiple-choice, with five answers to choose from. Students could choose up to 3 main influences based on the options provided:

- Friends influence/ wanting to fit in.

- Lack of self-control: buying anything you want just because.

- Having to provide for your family.

- Anxiety about college or your future.

- Wanting to be wealthy when you are older.

The top three answers were all separated by a one-point difference between each! Ranked in first place with the most votes was option #2- lack of self-control- at 27/55 responses. Coming in second with 26/55 votes was option #4- anxiety about college or the future. And finally, at 25 votes, was option #5- wanting to be wealthy as an adult. Is this what you would have expected your peers to answer?!

This is what I expected, especially the top results for option #2. I see this in my peers, my friends, and on social media every day. I also see it in myself. Just because I may not buy everything I want does not mean I don’t have the temptation to. You should see my Amazon cart; it can get bad. Humans are naturally selfish, but it goes back to learning sacrifice and practicing self-control now, so we don’t always spend all our money on things we genuinely do not need.

As a senior who is planning on going to college in the fall, I see how many other students also have anxiety about the cost of college (or the future in general). These things get expensive and add up quickly, sometimes before we even realize it. That is why understanding your spending habits, learning what triggers you to spend money, and what you value is important to figure out while you are still young, that way when these expenses all come at once, you feel ready to handle them.

Overall, the biggest thing I learned from this survey is that my peers are aware of the influence money has on them, and they do have the intention to be responsible for it. It may just take some time, practice, and trial and error to find a budgeting technique that works for you, but all that matters is you are trying.